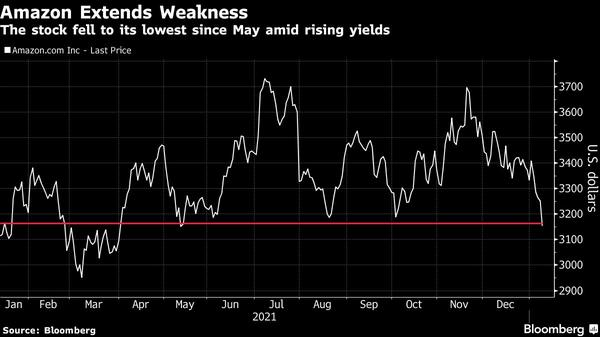

Amazon falls to a minimum since May; technological actions continue to weaken

Final scorectionsUltimatizations

Bloomberg-the stock of technology and Internet companies fell on Monday, deepening their recent declines as investors continued to closely monitor increases in yields on US Treasury bonds.

Losses were widespread throughout the group, with mega-capitalization companies falling, semiconductor values and software sector values. The group led the declines in the US stock market, and the Nasdaq 100 index lost more than 2%.

PUBLICIDADThe fall occurred when the 10 year return on US Treasury bonds increased to 1.8%, the highest yield in almost two years. Higher rates are considered a challenge for high-growth and relatively expensive actions, as they reduce the present value of future gains.

Destacó Amazon.com Inc. (AMZN) con una caída del 3,4% a su nivel más bajo desde mayo. La acción ha perdido cerca de un 15% desde su máximo de noviembre y lleva una quinta sesión consecutiva a la baja.

Bank of America stated a purchase recommendation and target price of US $4,450 for the stock, saying that it expects 2022 to "finish better than it starts." The firm has selected Amazon as its main mega-capitalization action, and expects several winds against (including supply chain and labor problems, slowing e-commerce growth, and multiple compression) to "lighten up throughout the year."

PUBLICIDADGoogle's parent company, alphabet Inc. (GOOG), fell 2.8% and added its fifth day down, its longest run since November 2019. The stock has lost about 8% in the five days of decline and is listed at its lowest point since October.

Entre otros nombres, Microsoft Corp (MSFT) cayó un 2,7% hasta su mínimo desde octubre. Tanto Microsoft como Alphabet vienen de sus mayores bajas porcentuales en una semana desde marzo de 2020. También el lunes, Apple Inc. (AAPL) bajó un 2,1% y la matriz de Facebook, Meta Platforms Inc. (FB) cayó un 4,5%. Tesla Inc. (TSLA) perdió un 2,8%.

The Philadelphia stock exchange semiconductor index dropped by 2.4%. Among the most prominent names, Nvidia Corp. (NVDA) dropped 5.4%, Advanced Micro devices (AMD) lost 3.4%, Marvell (MRVL1) ceded 5.1% and micron Technology (MU) dropped by 2.8%.

PUBLICIDADGhack.net: how to show hidden files in Windows 7: the Windows 7 operating system, like its precursors Windows V... Http: / / bit.ly

— techupdate Wed Apr 14 08:03:24 +0000 2010

Jordan Klein, director gerente de Mizuho Securities, señaló que la debilidad de los fabricantes de chips se debe a una caída similar en los nombres de software.

"could this be a sign of a much wider rotation outside of technology in general, with exposure to the best-performing group in technology during 2021 that is now shrinking?" he said in a note. The semis, he adds, "carry a high relative risk if this becomes a general rotation outside of technology in general, where low relative valuation does not help."

El fondo cotizado iShares Expanded Tech-Software Sector (IGV) cayó un 3,2% el lunes. El ETF ha bajado más de un 20% desde su máximo de noviembre, tocando su mínimo desde junio.

PUBLICIDADGiven the magnitude of the software's weakness, some analysts are beginning to see deals in the group. Previously, William Blair wrote that off-software rotation "will be short-lived as the sector continues to benefit from strong secular growth trends." Analyst Bhavan Suri is "confident that the software industry will exhibit lasting growth and that the overall business fundamentals remain intact."

You may be interested:

Great technology was revalued US $2.45 billion thanks to solid profits

PUBLICIDADAmazon's year-end sales forecast indicates that bonanza ended

2021 was the year of the supermillionaires: they amassed $1 trillion in profits.

This article was translated by Estefania Salinas Concha.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...