The Ibex 35 will try today to consolidate the 8800 points

Today's session becomes interesting with the arrival of weighty macroeconomic data, such as the change in private employment in the United States, which will serve as an appetizer for this Friday's official employment report. We will also be attentive to oil inventories, once black gold has started its recovery towards resistance zones with the objective of entering again above 80 dollars.

On the other hand, despite the strong increase in infections in Europe due to the omicron variant, investors insist on propping up their portfolios, since they estimate that economic growth can be maintained for much of the year, although with concerns about continued price increases , which will continue to rise during 2022.

On the other hand, Evergrande shares returned to trading on the Hong Kong Stock Exchange, with rises above 5% on Tuesday despite the fact that the company reported sharp declines in sales. However, investors are still waiting for the next debt maturities and above all, if it will be able to face them.

Finally, today we will have relevant macroeconomic data, among which we highlight:

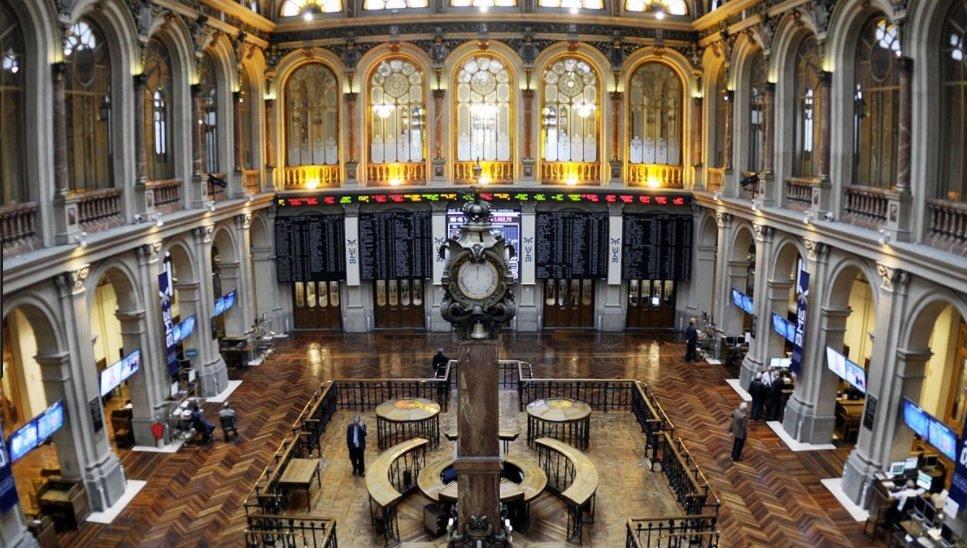

Technical analysis: Ibex 35

At 9:01 am, the Ibex 35 started Wednesday with gains, posting 0.15% to 8,808 points. The Spanish index once again closed a positive day thanks to the rebound in the banking and tourism sectors, noting the biggest increases.

Technically, the Ibex 35 is attacking the resistance zone of 8,800 points, a consolidation objective that investors will have in today's session, after recovering more than 9% from the lows set last December. Therefore, the volumes around yesterday's highs will be key to knowing the direction of the Spanish selective.

Finally, the offer also enters the scene within the Spanish index, so the action of the sellers continues to be key around 8,750 points, and may even nullify any attempt by the buyers to continue with the recovery of resistance zones, therefore that could force the Spanish index to retest the 8700 points if the sales prevail over the purchases.

Guys i wanna figure out how to get fortnite season 3 back. Like i wanna get the files to season 3 and idk maybe fin… https://t.co/k74PB7fBw5

— pogo Mon Oct 01 18:12:16 +0000 2018

The banking and tourism sector pull the Ibex 35

Within the Spanish selective, the banking and tourism sector yesterday sustained the gains in the Spanish index, highlighting the strong rise of IAG (+4.99%) yesterday, which accumulates a rise of more than 9% in 2022 and is attacking important resistance , as are the 1.90 euros.

For their part, Banco de Sabadell and Banco Santander posted increases above 2.5% yesterday, entering again above 0.60 euros in the case of the Catalan bank, while Santander will try to establish itself again above 3 euros .

Finally, on the negative side, Cellnex Telecom suffered a correction of more than 5% and once again lost the psychological level of 50 euros. Likewise, we had Laboratorios Rovi, losing more than 4% to 69.00 euros, down around 7% from its all-time highs.

Download our 24-hour trading guide now and take advantage of all the opportunities

How to take advantage of the opportunities in this market? Example of operation.

To illustrate how to trade in the example, we are going to use the Ibex 35. At IG, we could trade this market with CFDs, barrier, vanilla options and Turbo24. We are going to select the latter for the example, since it is a product listed on a 24-hour market, which allows us to adapt the leverage of our operations and be covered against market gaps, the minimum purchase being a Turbo24 (equivalent to €0.01 per point).

In the event that the first scenario is confirmed and it is decided to enter bullish, we would buy 100 long Turbo24s (1 euro per point). Let's imagine that the Ibex 35 is trading, for example, at 8730 points. We could put the exit level or knockout (guaranteed stop) at 100 points below the entry price. If at that time, the price of the Turbo24 is 2,077 euros, the requested guarantee (remuneration) will be 207.7 euros (100 Turbo24 x 2,077 euros for each Turbo24). The leverage of this operation would be 42.03 times (8730 / 207.7 euros = 42.03 times). In addition, it has the advantage that if there are increases in volatility when the market is closed that trigger our knockout, the trade is not closed. This implies that, if when opening the cash market it does so in our direction, we will continue inside and we could continue obtaining profits. If, on the other hand, when the market opens, it does so at a price equal to or greater than our knockout price, we are guaranteed the maximum loss at that initially deposited amount, so we are covered against bull market gaps.

In the event that the second scenario is confirmed and it is decided to go bearish, we would buy 100 short Turbo24s at an Ibex 35 price of 8,650 points. We could put the knockout level, for example, 100 points above the entry, with a price of the Turbo24 at 0.996 euros, the requested guarantee (retribution) will be 99.6 euros (100 Turbo24 x 0.996 euros for each Turbo24). The leverage of this operation would be 86.85 times (8,650 / 99.6 euros = 86.85 times), maintaining all the advantages explained above and protection against negative balance in the event of bearish market gaps.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...