IAG rebounds 11% but is still 33% from 2021 highs

- Cecilia Moya

The tourism sector has started 2022 with a significant rebound in the Spanish parquet, after the drop it registered part of this industry last year, when the coronavirus pandemic continued to spread its tentacles to, above all, activities related to leisure or travel, given that the mobility restrictions imposed to reduce the incidence of the virus go against the interests of this market.

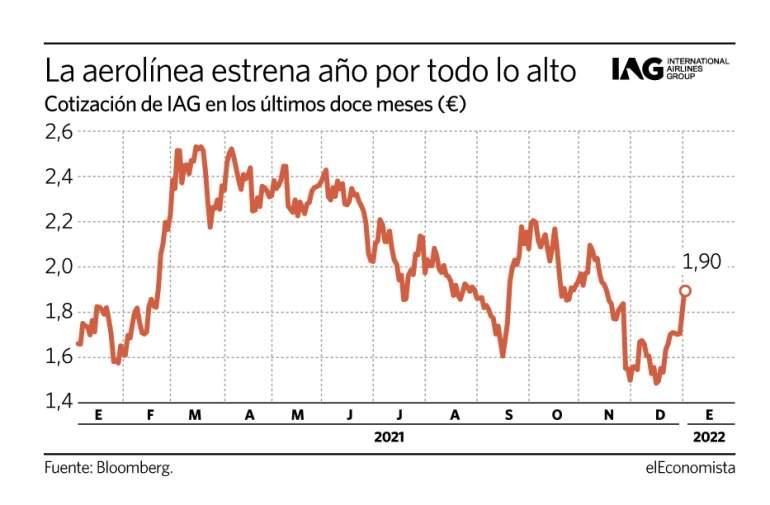

This is demonstrated by the group of airlines International Consolidated Airlines Group (IAG) , which has been the most bullish value of the selective of the 35 in the first two sessions of the year, and has managed to score a rise of 11.24% so far this year, with a closing price of 1.90 euros this Tuesday. However, despite this good start, the company, which lost more than 5% on the stock market last year, is still 33.1% away from returning to the highs of 2021 , which played on March 17, priced at 2.53 euros.

KITCHENSTUDIO3 : How to open RTF files in POP3 in Galaxy SII: hi guys, I bought a new galaxy… http://goo.gl/fb/8Mmtj

— KITCHENSTUDIO3 Sun Jul 24 09:35:14 +0000 2011

Margin of recovery

Like the rest of the sectors and companies in Spain, in particular, and the world in general, IAG suffered the effects of a black November after the uncertainty caused by the then new omicron variant of Covid-19, which resulted in a stock market drop for the airline from that month until the end of the year.

In this sense, the company registered lows on December 15, with a price of 1.48 euros, therefore, although it still has a significant margin of recovery to approach its pre-omicron level, after achieving a rebound of more than 27% since it touched that ground. Analysts, for the moment, do not believe that it will reach those 2021 highs judging by the target price they foresee, of 2.39 euros according to the FactSet consensus.

However, most experts agree that it is a good time to enter. The airline is the company with the best recommendation in the tourism sector, being the only one in this industry with a buy recommendation by market consensus.

Beyond IAG, other stocks in the tourism sector have also started the year with gains. Meliá recorded 5.30% in two days, Aena 4.07% and Amadeus, 3.72%, while the Ibex gained 0.94%.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...