IAG, Ryanair and Easyjet: Near to gain height in the stock market

The managers focus on the airlines, anticipating the recovery of a sunken sector that they trust will come sooner or later.

Airline companies are sticking their heads out on the stock market at the start of 2022, after two extremely difficult years for one of the sectors most directly affected by the Covid-19 crisis. Despite the fact that mobility restrictions not only continue in many countries, but will continue to be a threat as long as the pandemic is not controlled, investors are already focusing on these values.

"Very rarely in life do you have to invest in airlines. Perhaps this moment is one of them," says José Ramón Iturriaga, partner at Abante Asesores. In this sense, Iván Martín, founding partner and investment director of Magallanes Value Investors, assures that it is a traditionally cyclical sector, in which one invests "in bad market moments, when nobody wants them", for which he believes Now there is a good opportunity.

The market recognizes that valuations are attractive. "They are very low and they are going to recover sooner or later. I do not see capital or balance problems in many of them," says Lola Solana, manager of Santander AM. "It is one of the sectors that we recommend the most for this year because [the airlines] are weighed down, behind the recovery. The normalization of the situation should benefit this type of company," adds David Ardura, co-director of investments at Finaccess Value .

The vision is, in general, positive, but the experts emphasize that it is important to select. "There are many business models that are still very weak. For example, that of Air France-KLM, which needs a lot of support from government subsidies," explains Tomás Pintó, director of international equities at Bestinver.

Despite the fact that the Franco-Dutch airline is trading at knockdown prices (60% below pre-Covid-19 levels), not a single firm that makes up the Bloomberg consensus advises buying. The Swedish SAS or the Finnish Finnair do not have purchase recommendations either, and in Lufthansa only 21.4% of the houses are inclined to buy their titles.

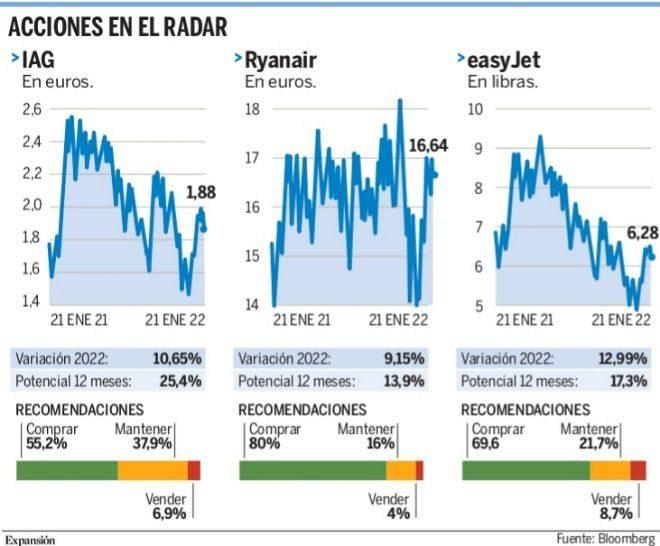

Among the traditional flag carriers, the one attracting the most interest is IAG. The holding company in which Iberia is integrated has appreciated 10.65% on the stock market so far in 2022, after dropping 4.86% in 2021 and collapsing 62.58% a year earlier, at the worst of the crisis . It offers a 12-month bullish run of 25.4% to the Bloomberg consensus price target of €2.37.

Potential

There are more optimistic firms, such as Banco Sabadel, JB Capital Markets or GVC Gaesco Valores, which value the shares at 2.7 euros; Stiefel gives them wings up to 3 euros. "He's got a solid enough balance sheet to handle everything he's put through in the last two years," argues Ardura. Bank of America analysts view IAG "as a strong company with a superior cost structure" and have upgraded their rating from "neutral" to "buy." In Bankinter, which advises buying IAG with a target price of 2.5 euros, but only to dynamic investors and with a long-term time horizon, they stress that "the mass vaccination program, the reactivation of the economy and the reopening of flights -especially with the US- allow us to anticipate that the worst is behind us and that there will be a progressive improvement in its results". However, these experts affirm that it is convenient to monitor the impact of the oil price on the holding company's accounts, as well as its balance sheet and the evolution of Covid-19. Renta 4 experts expect that the offer will recover the level of 2019 in 2024 and that the demand will continue to be lower (around 15% lower) in 2025 than in 2019, mainly due to the fact that part of the business traffic of long haul, which is already showing signs of recovery, may not recover due to structural changes. They place the target price of the holding's shares at 2.55 euros and advise overweighting.

More attractive

In any case, to take advantage of the sector's potential, managers prefer airlines that do not depend on government aid, but rather exhibit a more independent profile and their own merits, such as easyJet, Ryanair or Wizzair. 80% of Bloomberg firms advise buying Ryanair, with a revaluation potential of 13.9%. Its balance sheet is one of its great strengths, with a high level of liquidity thanks to the reduction of investments and costs, as well as a good rate of debt reduction, they say at Bankinter. At Credit Suisse they underline that Ryanair is the airline best positioned to weather the headwind of inflation due to its limited exposure to regulated airports (less than 50% of passengers before the pandemic) and the greatest bargaining power in the sector.

Buying advice on easyJet, which is up 12.99% in 2022, reaches 69.6%, and its journey is 17.3%. Wizzair's potential is more limited (11.3%) and the analysts' view is more cautious: only 40% are inclined to buy and 36% opt to hold.

The Spanish star stock that triumphs in Europe and has the support of analystsHow can I earn 5% above inflation with my portfolio? Energy and cyclical stocks, heads and tails of the Ukraine crisis

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...