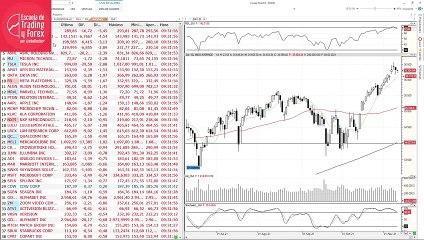

Invertia The Ibex closes above 9,100 points despite the high IPC data in the US.

After yesterday's and today's falls on Wall Street and the three-month lows in the Chinese stock market, today it seemed logical that Europe would see falls. However, the Ibex closed with increases of 0.74% to 9,141 points after marking a minimum of 9,059.

The most bullish stocks today have been Siemens Gamesa (+7.43%), Telefónica (+2.95%) and Repsol (+2.35%).

On the downside, no weight value: Meliá (-1.79%), Arcelor (-1.35%) and Fluidra (-1.19%).

Let's remember that yesterday both the Dax and the Cac set record highs. And Tesla shares plummeted because of the famous Twitter poll over the weekend, even though they are bouncing today.

After having already confirmed the already known data of the German CPI (4.6% interannual), the CPI data of the United States has been very high: 6.2% interannual (against a forecast of 5.8% and a previous one of 5.4%). The underlying has remained at 4.6%.

And Evergrande is expected to avoid default again at the last moment.

"The expectation is that it will be paid," said Karl Clowry, restructuring adviser and partner at Addleshaw Goddard LLP: "It would be quite a surprise if the funds did not flow to the trustee in the required timeframe, given the immediate cross-default and domino effect on suppliers and the real estate market in the People's Republic of China in general".

This afternoon the drop in crude oil is in the news after the highest inventory data in the US: Brent is around 84 dollars. Throughout the day the price of gas in Europe has been falling.

The cryptos had been correcting for the entire session after the highs experienced at the beginning of this week but after the IPC data they have turned around and both bitcoin (69,000) and ethereum (4,860) have set new all-time highs.

The euro / dollar cuts to 1.1530 while gold has shot up after the CPI data to 1,865 dollars an ounce, a maximum of five months, although it is now around 1,555.

The Spanish Treasury has today issued bills for six and twelve months. At six months the Treasury has placed 937.05 million euros, against a demand of more than 1,758 million, and the marginal interest rate has been placed at -0.650%, more negative than the -0.630% of the previous auction of last month. In the 12-month issue, 4,160.68 million euros have been awarded, below the 6,737.62 million requested by investors. The marginal return offered stood at -0.626%, also more negative than the -0.571% of the previous issue.

Naturgy obtained a net profit at the end of September of 777 million euros compared to 490 million a year ago, which represents an increase of 58.6%. These results include net capital gains of 187 million euros, generated by the divestments of the electricity business in Chile and the participation in UFGas in Egypt. They have not liked much in the stock market.

Ercros earned 26.17 million euros in the first nine months of 2021, 471.4% more than in the same period last year. Likewise, it increased its gross operating profit (or EBITDA) by 70.8% year-on-year, to 59.81 million. As for the company's turnover, it increased by 34.1% compared to January-September 2020, exceeding 587 million euros.

Coca Cola Europacific Partners has recorded pro forma income of 10,932 million euros, 3.5%, and has announced a dividend of 1.40 euros to be distributed in December, after the purchase of Amatil. The largest Coca-Cola bottler has invoiced 3,949 million euros in the third quarter, a drop of 1.5%, due to the adverse context in Europe and the new restrictions in Asia Pacific.

The Reno de Medici paper mill has reduced its net profit by 52.4% to 15.5 million euros between January and September, pressured by higher energy and fiber costs. The company has increased its sales by 26.6% to 544.1 million euros and has presented a gross operating profit (Ebitda) of 28.6 million euros, half that of the previous year.

Codere recorded net losses of 243 million euros in the first nine months of the year, a figure similar to that of the same period in 2020 (-240 million euros), due to the closure of its stores during the first half of 2021 as a result of the Covid pandemic. However, the gaming multinational increased its turnover by 8.5% between January and September after the reopening in July of its premises in Argentina and Uruguay, and after the closures derived from Covid-19 during the previous months.

Siemens Gamesa has announced this Wednesday that its prototype in Brande (Denmark), celebrates a new milestone by producing green hydrogen. The Danish company Everfuel is responsible for distributing it to hydrogen stations in the Nordic country, thus allowing its use by zero-emission vehicles, such as taxis. Its shares have reacted to the news very positively.

The BME Growth Market Coordination and Additions Committee has submitted a favorable report to Sngular for inclusion in the index, making it the fourteenth company to be added so far this year. Sngular People, which is dedicated to the design, development, deployment and promotion of transformation projects based on technology, obtained a profit of 4.35 million euros in the first nine months of the year, 79% more than the 2.42 million registered in the same period of the previous year.

Iberdrola has placed 750 million green hybrid bonds on the market at 1.575% interest, below the 2% established at the beginning of the placement. The demand has been placed at 2,300 million euros, more than three times higher than that offered by the energy company, which will use these funds to finance or refinance "green" projects. It is perpetual debt although there is the option of early repayment in the sixth year. Until then, the securities will accrue an annual coupon of 2% and after that the interest will be recalculated every five years.

Acciona has won a new contract in Australia valued at 191 million Australian dollars (121 million euros) to expand one of the main arteries in the town of Stirling, located about 10 kilometers north of Perth.

Tomorrow they present results ACS, Arcelor, CAF, NHH, Talgo and Vocento. Banco de Sabadell analysts have the following recommendations about them:

ACS: Buy with PO at 31.3Arcelor: Buy with PO at 32 CAF: Buy with PO at 46.73 NHH: Sell with PO at 3.67 Talgo: Buy with PO at 5.88 Vocento: Buy with PO at 1, 6

Shares of Coinbase Global Inc. fell after the largest U.S. cryptocurrency platform reported third-quarter results that missed Wall Street estimates. Coinbase, which blamed market turbulence and lower prices for part of the third quarter, reported revenue of $1.24 billion, lower than the $1.57 billion forecast by analysts. Users who carry out monthly transactions on its platform were 7.4 million, compared to 8.8 million in the second quarter. Its verified users increased to 73 million.

China's inflation risks are mounting as producers pass on higher costs to consumers, reigniting debate over whether the central bank has room to ease monetary policy to support a weakening economy. The producer price index rose 13.5% from a year earlier, hitting the fastest pace in 26 years. The consumer price index rose 1.5%, the fastest pace since September 2020.

Japanese manufacturer confidence hit a 7-month low in November. On the other hand, the new Japanese Prime Minister, Fumio Kishida, stated that the new government is working on a new fiscal stimulus package. Kishida said the stimulus package will be compiled by the end of next week, adding that it will be worth "tens of trillions of yen."

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...