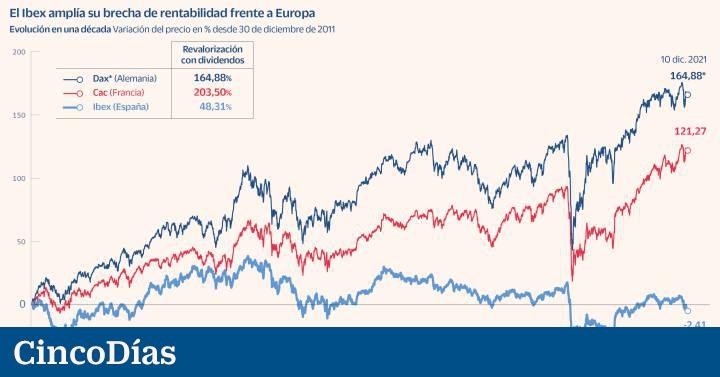

The Spanish stock market shrinks in the global market: why the Ibex lags behind

The Ibex has scandalously widened this year the profitability gap that separates it from the rest of the European indices. The gain of 3.55% that it accumulates in the absence of three weeks until the end of the year is far from the increases of its European neighbors, which comfortably exceed 15%. The French Cac leads the rises with a rise of 25.9%; the Dax appreciates 13.8%, and the Euro Stoxx 50, 18.2%. The Italian FTSE Mib also beats the Ibex by a landslide with a revaluation in 2021 of 20.2%.

What happened this year in the Spanish selective confirms a weakness that comes from a long time ago and that has been aggravated by the pandemic. The greatest punishment of investors to the values most attached to the economic cycle has been primed with an index in which the banking and the tourism sector have a weight equivalent to a third of the total. And in which Iberdrola –the value that weights the most in the selective, with 13.7%– suffers a drop in the Stock Market in the year of more than 16%. On the other hand, Sabadell and Fluidra, the values that have shone the most in 2021 with respective increases of 66.5% and 56.3%, each barely represent 1% of the index.

The Spanish Stock Exchange had its brief moment of glory this year in the spring, when the discovery of the coronavirus vaccine had given wings to the companies most affected months ago, such as banking and tourism. “Until April the Ibex beat its European neighbors. But it has a structural problem, with a great absence of technological values. It is sad, but we have very little Spanish Stock Market in our portfolio”, admits Ignacio Cantos, director of investments at the firm Atl Capital.

The abundance of cyclical stocks makes the difference and could be an advantage in 2022 on a reversal in rates

A look at the composition of the rest of the European indices and the behavior of the values that make them up provide a revealing explanation of what investors' preferences are and why the Ibex lags behind in profitability. The value that weighs the most in the Euro Stoxx 50, with 9.2%, is the Dutch technology company ASML, the world's largest supplier of photolithography systems for the semiconductor industry. In the year it is revalued more than 60%.

Another of the stars of the Euro Stoxx is the German Linde, which has a weight of 4.5% in this index and 9.6% in the Dax, and whose shares are up almost 30% this year. The second value with the most weight in the Dax is the multinational software company SAP, which is revalued in 2021 by more than 12%. In the case of the French Cac, which this year has set new all-time highs, the weight of luxury stocks, European giants by capitalization, is decisive. Hermès leads the Gallic index in 2021 with an increase of close to 80% and a market value of more than 166,000 million euros. LVMH's rise in the year is around 40%, to a market capitalization of 360,000 million euros. In the Spanish Stock Market, Inditex is the company that is worth the most: 89,700 million euros. His profit for the year does not reach 10%.

For Roberto Ruiz-Scholtes, director of strategy for UBS in Spain, “the Ibex has a structural composition problem. In the previous crisis it had a worse behavior due to brick and in recent years its worse evolution is explained by the absence of large technological or luxury groups. No need to seek three legs on a cat". This composition of the index, with 12 small capitalization values whose weight is less than 1%, has also cornered the Spanish Stock Market in the eyes of large international investors. As Ruiz-Scholtes explains, "the large funds take positions that do not exceed 1% or 1.5% of a company's stock trading volume, so as not to distort the prices." And at that threshold only a dozen Spanish securities move.

In fact, the Spanish stock market barely has a representation of 1% of the MSCI World index, in which the values of the US stock market account for 69.3% of the total and the French, the main representatives of the euro zone, account for 3.1%. “The vast majority of Spanish companies are off the radar of international investors. Many managers, especially passive managers, do not enter the Spanish Stock Exchange due to the composition of the Ibex, despite the fact that there are companies of great quality and potential”, defends Gonzalo Sánchez, director of investments at Gesconsult. He claims the value of companies such as CIE Automotive, CAF or FCC, although none of them come close to being worth 5,000 million euros on the stock market.

Who knows how to convert an mp3 file easily into an mp4 file on a mac?I need your brilliance...google just isn't helping today

— Maggie Emerson Tue Jun 26 18:52:43 +0000 2018

The selective Spanish suffers from the absence of technology and luxury, the stars in Europe

Proof of the weak pull of the Ibex among investors is the evolution of the companies that become part of the index. If there was a time when the incorporation was almost equivalent to the rise in the stock market, today the opposite is happening, according to Ignacio Cantos. “Everything good is discounted first, the new values of the Ibex then fall”, he adds. This is the case of Solaria, which has corrected almost 10% since its entry on the Ibex in October last year, a year in which it had accumulated a strong revaluation.

For Federico Battaner, head of Spanish equities at Trea Asset Management, "the Spanish stock market should be more in the focus of international investment since we are the fourth largest economy in the euro zone." It acknowledges, however, that big capital "has not just put Spain on the map", a fact that is explained in the first place by the aforementioned composition of the Ibex, by the exposure of the large listed companies to more vulnerable emerging economies such as Latin America and also due to factors that have to do with the Spanish economy itself, highly dependent on the services sector, with a lower weight of industry than that reflected in other European stock market indices, and with high rates of unemployment and public debt.

“Legislative interference in sectors such as electricity do not give investors security. Spain must also send a message of commitment to the reforms of the labor market and pensions and of firmness in the use of European funds”, adds Battaner. In any case, he denies that the Ibex listed companies suffer any kind of penalty for being Spanish companies.

The country's economy is more affected after the pandemic, but managers do not appreciate political risk

"Politics is not the problem of the Spanish stock market," says Roberto Ruiz-Scholtes emphatically. In his opinion, "the political risk was far behind from the moment the market understood that the ECB acts as a support, no matter how cumbersome Spanish politics may be." José Ramón Iturriaga, manager of Spanish equities at Abante Asesores, argues that the poor performance of the Spanish stock market in recent years is essentially due to a long cycle of unprecedented zero rates. "It has nothing to do with Pedro Sánchez, neither for better nor for worse," he says.

Iturriaga does trust that 2022 will be the beginning of a new cycle for the Ibex, in line with the change in direction of monetary policy. “There is a great opportunity, the main catalyst will be the current fundamental valuation. The circumstances are right for the Spanish stock market to shine in the coming years”, he adds. At UBS they also predict a good 2022 for the European and Spanish stock markets and see the Ibex at 9,600 points at some point in the year, even without technology companies.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...