Softbank announces the departure of Marcelo Claure; Michel Combes will take over

Latest QuotesLatest QuotesNasdaq13,770.57+3.13%Ibovespa111,910.10-0.62%S&P/BMV IPC50,661.86+0.39%BTC/USD38,033.70-0.92%

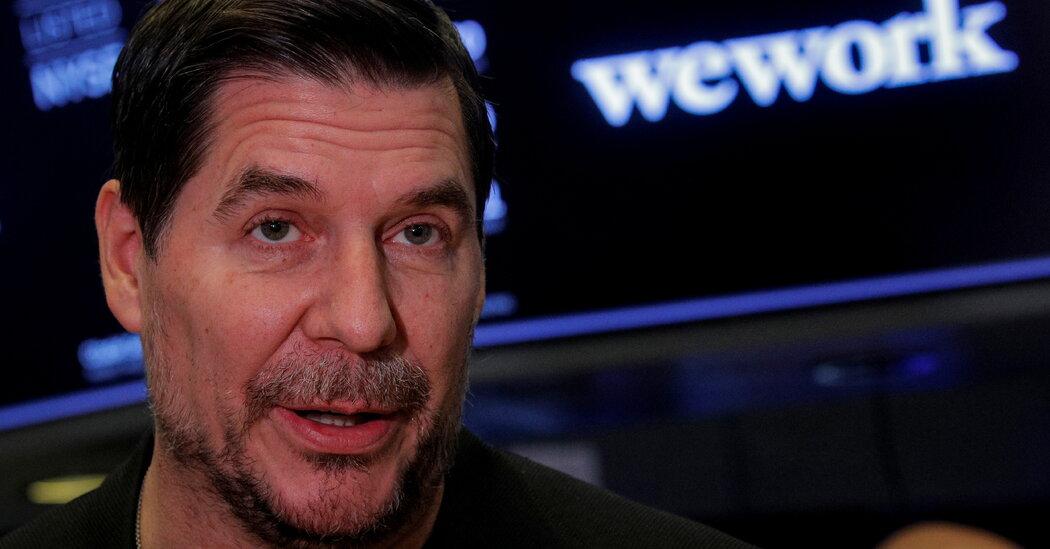

Bloomberg — SoftBank Group Corp. confirmed that chief operating officer Marcelo Claure is leaving the group, ending a tumultuous tenure, which culminated in a conflict with founder Masayoshi Son over salary and responsibilities.

Michel Combes will take over from Claure at SoftBank Group International and oversee SBGI's trading and investment portfolio , the company said in a statement. The announcement confirms an earlier report by Bloomberg News.

ADVERTISING“Marcelo made many contributions to SoftBank during his time here. We thank him for his dedication and wish him continued success in his future endeavours,” Son said in the statement. "I have great confidence in Michel Combes and the talented team at SoftBank to continue the great work we have in progress at SBGI." Claure, for his part, wrote in the statement: "I will be eternally grateful for my experience at SoftBank over the past nine years," he said. “We have invested in some of the most innovative and disruptive companies that will be industry leaders for decades to come.”

Claure, 51, became one of Son's top associates after selling his cell phone distributor to the group in 2013. Years later, in 2018, he took over as chief operating officer of Softbank. The Bolivian-American was the company's operational guru, helping turn US mobile operator Sprint Corp. into workplace startup WeWork .

In recent months, Claure had been lobbying for more money and authority in recognition of his work. He was asking for compensation of up to $1 billion, much more than the 1.8 billion yen ($16 million) he earned in the last fiscal year .

ADVERTISING

Still, analysts said the announcement was unsettling. "This is negative because it gives the impression that management is confused and that some things are not going well," said Mio Kato, an analyst at LightStream Research in Tokyo. “It is possible that the current economic environment, which does not allow SoftBank Group's investment strategy to work, has caused these problems.

SoftBank shares are up 3% in Tokyo trading but are down more than 50% from last year's high.

So true. Too often I see individuals w/ a BS in #Cyber who have no clue how to interact with the environment. One… https://t.co/jiJJRJyKlb

— objMethod 💻📊 Sun Mar 31 00:32:17 +0000 2019

Claure has also advocated a spin-off of the Latin American investment fund he oversaw for SoftBank, Bloomberg News reported last year. He argued that spinning off Latin America would help build the business and create value for SoftBank, while also increasing his own compensation, people familiar with the matter at the time said.

ADVERTISINGThe group's founder saw little benefit in a spin-off for SoftBank shareholders and thought it would complicate management and governance, the people said. The Latin American company isn't as famous as SoftBank's gargantuan Vision Fund, but it has grown to $8 billion in assets since it launched in March 2019.

Son and SoftBank have had several success stories, including the public debut of Korean e-commerce pioneer Coupang Inc. But Son's company has suffered an avalanche of bad news in recent months, including China's crackdown on its technology companies. . SoftBank's most valuable individual investment, Alibaba Group Holding Ltd., has been one of the main targets of Beijing's antitrust effort. SoftBank is also a major financier of Didi Global Inc., the ride-sharing giant that said it would delist from US stock exchanges just five months after its IPO.

Outside of China, Indian digital payments pioneer Paytm, another SoftBank portfolio company, has suffered one of the worst IPO debuts by a major tech company. In December, US antitrust authorities filed a lawsuit to block chip designer Arm Ltd.'s sale of SoftBank to Nvidia Corp.

ADVERTISINGSee more at Bloomberg.com

-- This news was translated by Michelly Teixeira

You may be interested in:

Split of Softbank in Latin America generates tension between Claure and Masayoshi Son

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...