Sura and Nutresa shares still on the stock market

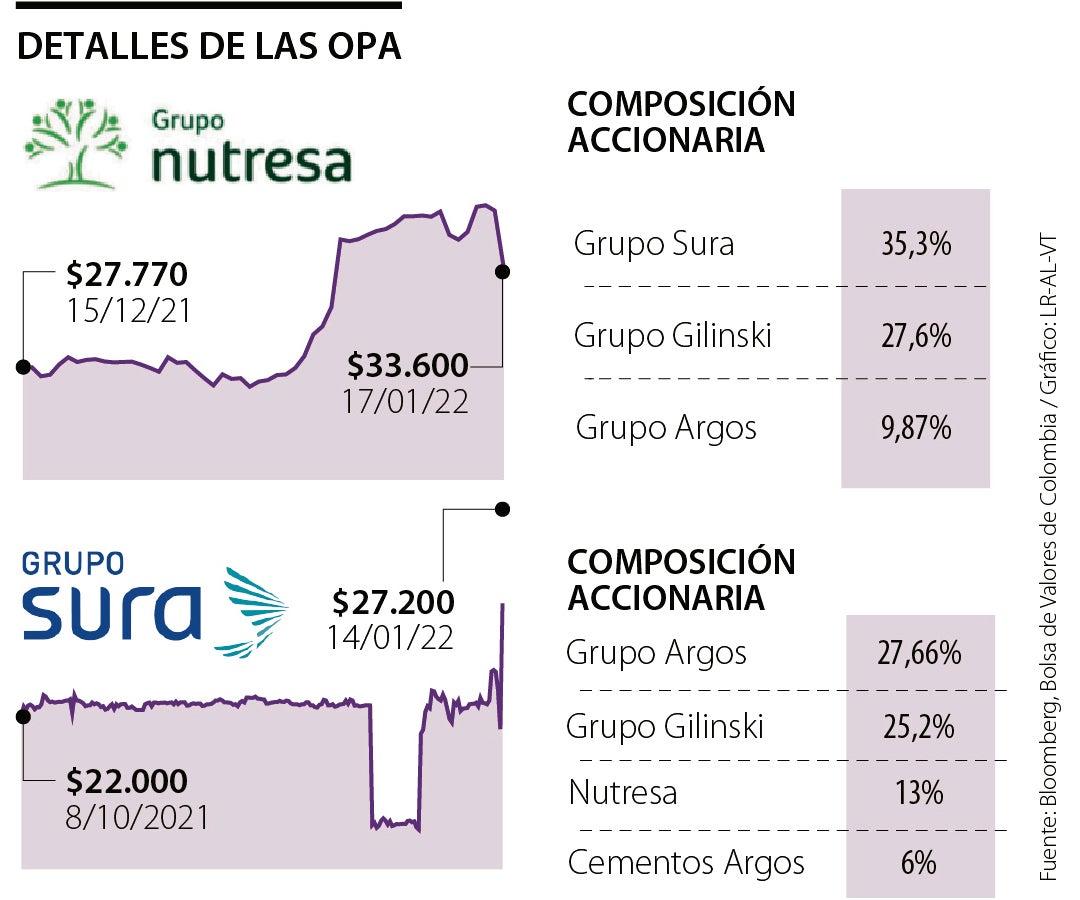

While the Sura and Nutresa groups reported the changes in their shareholding composition with the arrival of JGDB Holdings and Nugil, the stock market expects to know the notices and booklets of the new Public Acquisition Offers (OPA) with which these Jaime Gilinski companies seek expand their participation.

In Sura, the portion reached by JGDB Holdings in the first takeover bid was 25.3%, and its objective is to buy a minimum number of shares of 5% or a maximum of 6.25%, to obtain a participation between 30, 3% or 31.55% of the Antioquia financial holding company.

Guys..anyone knows how to edit a scanned doc image, want to change some texts in the document. #Help

— Mr.சரக்கஸம் Fri Jul 13 19:52:13 +0000 2018

With the new offer, Gilinski would pay US$9.88 per share, that is, he raised the price by US$1.87 compared to the US$8.01 that he paid in the first OPA. With the purchase of this new package, which ranges between 23,395,483 shares and 29,244,354 shares, Gilinski would disburse between US$231.14 million (about $916,337 million) and US$288.93 million ($1.14 billion).

In his turn, Nugil acquired 27.7% of Nutresa's shares, and with the second takeover bid he seeks an additional 18.3% and 22.88%, which would allow him to become the main shareholder of the company. holding food.

For this second offer, Gilinski also raised the price to US$10.48, that is, US$2.77 more than the US$7.71 he paid in the first offer. The disbursement for these new participations, between 83,813,260 shares and 104,789,475 shares, would represent between US$878.36 million and US$1,098.19 million ($3.48 billion and $4.35 billion, approximately).

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...