Sura and Nutresa's actions will resume their negotiation in the Stock Exchange

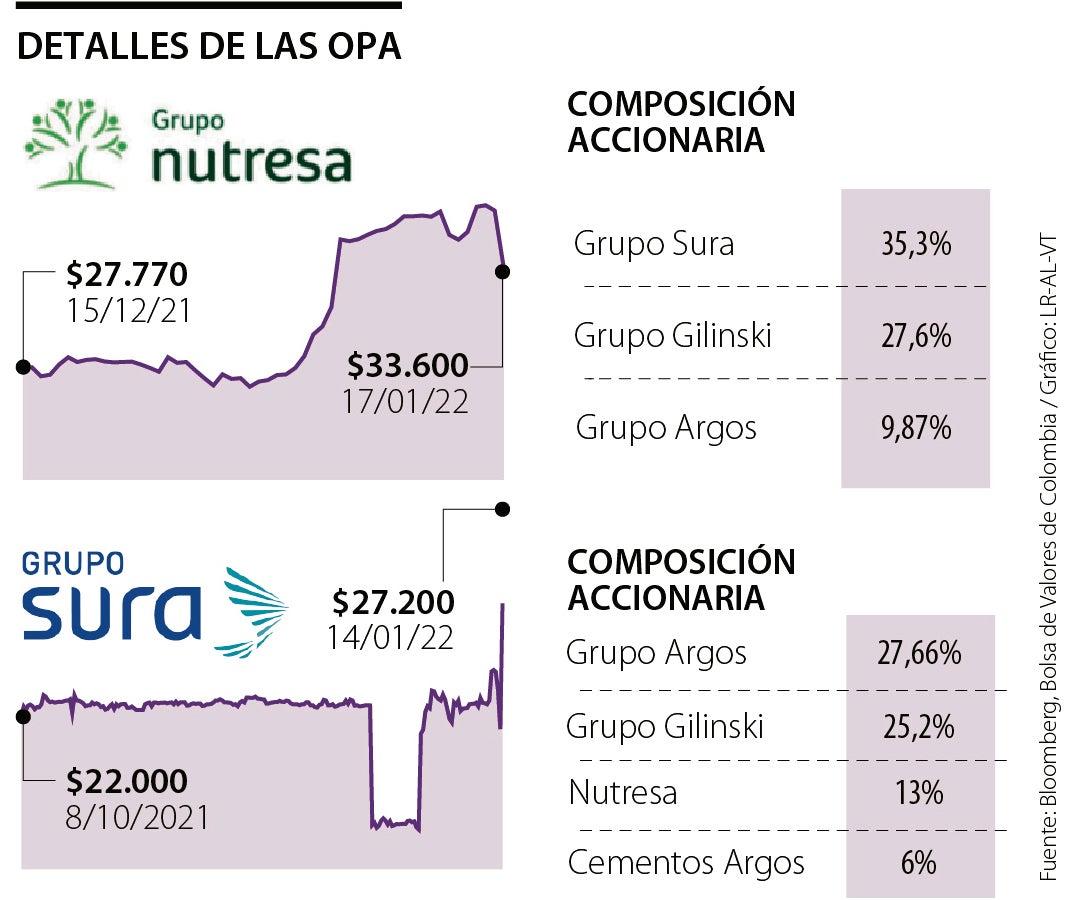

About 15 days after the proposal for the Public Acquisition Offer (OPA) presented by the Gilinski Group to buy an additional percentage of Sura and Nutresa, the Financial Superintendence of Colombia (SFC) and the Colombian Stock Exchange (BVC) authorized the operation.The price of both ordinary species will resume this Monday in the stock market.

ARTÍCULO RELACIONADOGilinski filed an OPA guarantee on Sura Group for up to US $ 115.6 million

A strong rebound of both is already expected during the first hours of negotiation, as happened during the first purchase. De hecho, entre noviembre y enero la de Sura ha crecido 12,7%, mientras que en lo que va del año se ha trepado 9,21%.

The preferential role has absorbed a large part of the value of the issuer, so it totals a rebound of 41.1% in the same period.

With this proposal, Jaime Gilinski, seeks to obtain between 5% and 6.25% of the ordinary titles in circulation of Sura, which is equivalent to between 23.3 million and 29.2 million papers.Under this panorama, the cost of this acquisition would range between US $ 230 million and US $ 288 million.

This price is 56.94% above the price registered by the sender when the first offer was submitted ($ 25.140).In addition, there is 44.79% on the last price of action ($ 27.250) and 24.69% on what Gilinski paid during his first OPA ($ 31.642.70).

ARTÍCULO RELACIONADOColfondos and Porvenir were the funds that most sold in the Gilinski group

As for Nutresa, whose OPA was authorized Friday at night, the Gilinski group's offer raises a price of US $ 10.48 per species. El inversionista buscaría un mínimo de 18,3% y un máximo de 22,8% de las acciones en circulación de la compañía.

This price is 89.03% above the price recorded by the sender when the first offer was presented ($ 22.140).In addition, there is 24.56% on the last price of Nutresa in the share market ($ 33.600) and 35.92% on what the caleño paid in its first purchase ($ 30.791).

If the OPA was successful, the employer would go from having 27.7% of this company, to achieve a 50.4% controlling percentage.

According to Édgar Jiménez, Finance Specialist at the University of Los Andes and professor at Jorge Tadeo Lozano University, these offers are looking for a better position in the Antioquia group."Increasing this factor gives you greater options of positions and decision power in the Board of Directors, which is one of its main motivations now," he added.

The contrasts

ARTÍCULO RELACIONADOSuperfinanciera authorized second OPA for Sura and each action will be paid at US $ 9.88

Now, in a range of five calendar days, three notice will have to be moved massively through high circulation newspapers, where, in addition, it must include the OPA acceptance period. Este lapso no puede ser menor a 10 días ni superior a 30 días hábiles.

However, the offeror may extend the period initially established for the acceptance of the offer and may not exceed the maximum period indicated.

First purchase was made with 35% of the capital of Jaime Gilinski

During the first purchase there was a disbursement of more than US $ 946 million, which Jaime Gilinski managed to keep 25.25% of Grupo Sura.This operation was carried out with 35% capital of the Caleño entrepreneur and 65% from the long -term financing of the First Abu Dhabi Bank, the same ally for the rest of its acquisitions inside the Antioquia Business Group (GEA).A similar partition would be observed in the transaction on Nutresa and possible OPA future around other companies at stake.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...