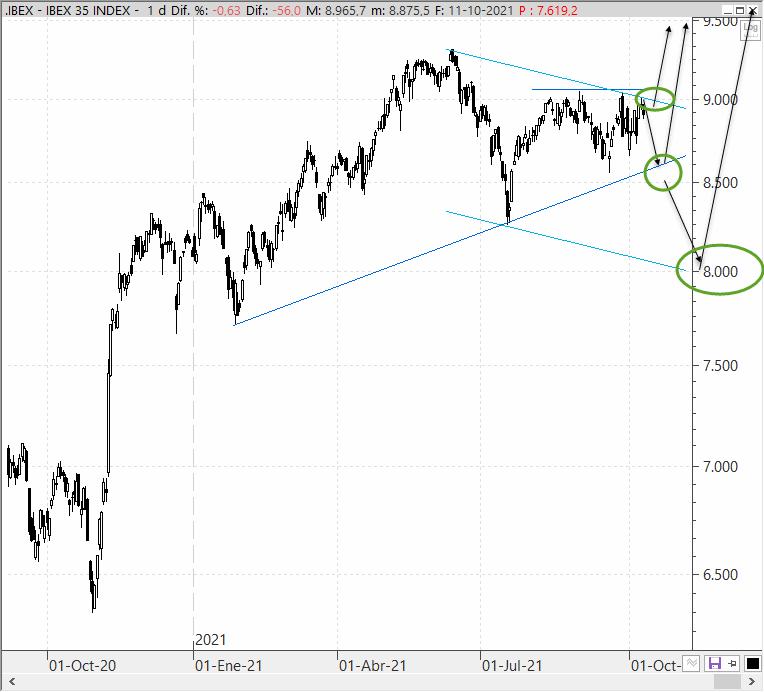

The 9,000 resist the Ibex and below you have to be very prudent

Above 9,055 points "the resumption of the upward trend could be favored towards first objectives at the highs of the year at 9,310 points and following in the area of 10,100 points, which is where it was listed before the Covid crash and that in I have pointed out on numerous occasions that it is the objective to seek in the coming months", remarks the expert in technical analysis of the investment strategies portal of elEconomista.

The EuroStoxx remains below 4,100

"So far, the correction we have seen from 4,252 to the 3,980 point area has been a replica of the one developed by the EuroStoxx 50 between June and last July, which led to the main reference from 4,165 to 3,904 points", observes Joan Cabrero, from Ecotrader.

"The reach of the 3,980 point area has caused an upward reaction in the short term in the EuroStoxx 50 which, with the reach of the first resistance of 4,100 points, is already beginning to find difficulties to continue advancing, something that continues to invite us to be very prudent", concludes the technical analyst.

Pinned to Wiki for Blind on @Pinterest: How To add brushes to sculptris https:/ /t.co/jSpABBa9gD

— Wiki for Blind Mon Sep 26 05:34:53 +0000 2016

Fear of inflation

The futures that trade on the reference indices of Europe and Wall Street anticipate falls this Tuesday due to concerns about high inflation, fueled by the high cost of energy, and the possibility of greater regulatory crackdown in China on companies.

The forecast of a CPI of 5.4% in the US in September (this Wednesday the 13th is known) requires the Fed to reduce debt purchases from November (tapering).

Oil reaches 84 dollars

The price of oil has not shown signs of weakness in recent days and continues to rise, both in Europe and in the United States, reaching 84 dollars in the case of the European Brent barrel and the 81 dollars in that of the American West Texas. The rise in Brent already represents a price increase of more than 62% so far this year.

With the arrival of vaccination, the economic recovery has been strong and, little by little, the world is returning to normality. However, the situation in the energy market and in other sectors such as semiconductors or transport has generated a significant imbalance, due to a strong increase in demand that the supply is not being able to satisfy.

For oil, the key is what is happening with natural gas. The price of this basic resource has skyrocketed in recent months, much more than that of crude oil (so far this year the price of natural gas has risen by more than 350%). This, however, is beginning to be transferred to the price of a barrel, which is increasingly in demand as a substitute.

The interest on the Spanish bond exceeds 0.5%

If we look at the secondary debt market and specifically the benchmark Spanish bond, with a 10-year maturity, we can already glimpse a tightening of the financing cost. The interest required has increased to 0.5%, from 0.2% in August of this year despite the record presence of the ECB.

Of course, this performance is far from the peak tension of the coronavirus crisis, 1.2% in March 2020, and far from the 7.6% that Spain came to endure in 2012.

The US bond remains stable this Tuesday at 1.6%, accumulating demand due to fear of inflation and the expectation of the withdrawal of stimuli by the Fed, while the German Bund remains in the - 0.12%, after reaching -0.5% in August.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...