The renewed appeal of Microsoft's action - Diario Financiero

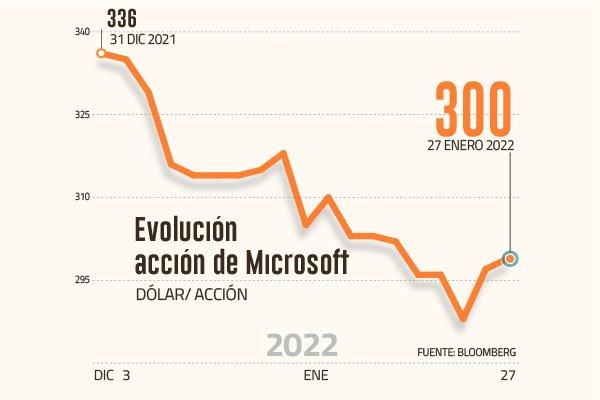

Keep, buy, overpower.These were the recommendations made by the majority of investment banks regarding Microsoft's action on Wednesday, after their positive utilities report of the fourth quarter.The role of the technology company came to jump 7% that day, to close with a 2.85% rise.Since then it has risen 4% to US $ 299.84 per share.

The company reported that income increased to US $ 51.730 million in the last three months of 2021, from US $ 43.080 million of the previous year.The average of analysts expected income of US $ 50.880 million, according to refinitiv data.Microsoft's largest business income, which offers cloud services and includes Azure, increased 26%, while those of the business that houses Office 365 grew 19%.

This good news adds to the announcement made by the company of billionaire Bill Gates, last week about the purchase of the Video Games Activision Blizzard, for US $ 68.700 million.

"Microsoft's results for this quarter were excellent," said Mexican firm Casa de Bolsa.Regarding the acquisition of Activision Blizzard, they point out that it is an opportunity to “become the third largest video game developer in the world and in the future these users to the metachos to generate new businesses”.They maintain their purchase recommendation and upload their target price target Microsoft to US $ 341 by 2022, with an expected yield of 18.2%.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...