This will make the integration of the stock exchanges of Colombia, Chile and Peru

Related article

"We hope to have a single stock market between Peru, Colombia and Chile in two years"

La Bolsa de Valores de Colombia ayer informó que su Consejo Directivo decidió entregar información a sus grupos de accionistas en el contexto del eventual futuro proceso de integración de la propiedad de la Bolsa de Comercio de Santiago (BCS), el Grupo Bolsa de Valores de Lima (Grupo BVL) y la BVC en lo que han llamado la “Holding Regional”.

After the analysis of a technical and multidisciplinary team of the stock exchanges of the three countries, a 17-page document was published, which was supported by six independent reports, which covered a tax, strategic, legal-regulatory analysis, of jurisdiction,Financial and Due Diligence valorization, in addition to specific advice for the drafting of a proposal for an integration framework agreement (AMI).

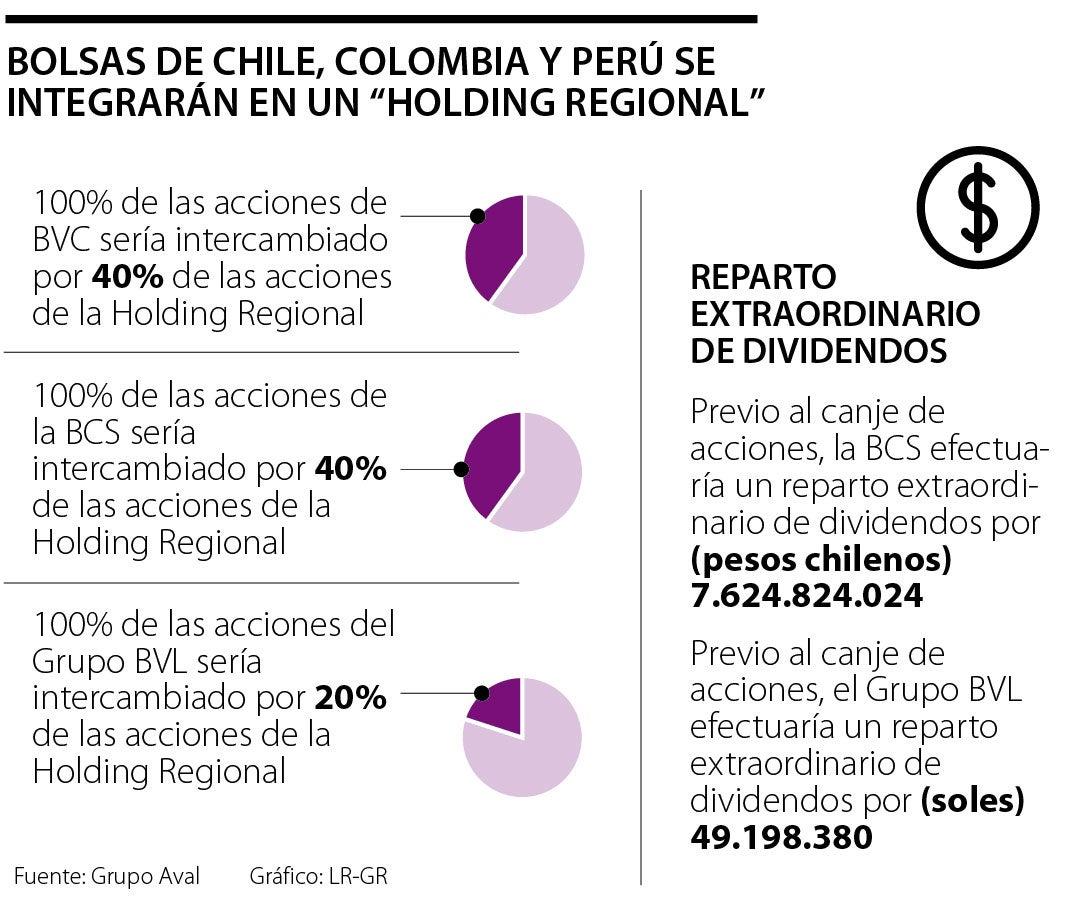

The first thing that is reported is that the integration evaluated by the Council contemplates the following exchange relationship: 100% of the BVC shares would be exchanged for 40% of the regional holding shares;Likewise, that 100% of the BCS shares would be exchanged for 40% of regional holding shares.Prior to the exchange of shares, the BCS would make an extraordinary distribution of dividends (7.624.824.024 Chilean pesos as of March 31, 2022).Finally, that 100% of the BVL group shares would be exchanged for 20% of regional holding shares.

And they also added that prior to the exchange of shares, the BVL group would make an extraordinary distribution of dividends and/or a capital reduction (49.198.380 soles as of March 31, 2022).

“In case of 100%of the shareholders of each entity, the regional holding company would compose, in a 40%/40%/20%ratio, by shareholders of the BCS, the BVC and the BVL group, respectively”, Explain in the report.

The contrasts

The process would begin with the signing of the framework integration agreement (which the shareholders of the BCS, the BVC and the BVL group and the respective companies subscribe).After the approval of the Boards/Shareholders, these groups would be cited in January 2022, then the activities in the legal-regulatory area are initiated and the closure and subsequent exchange of shares in July 2022.

And they explain at the end of the document: "Considering that the first milestone of integration will be the standardization of the negotiation platform, it is estimated that the implementation, considering the adequacy of the compensation, liquidation and deposit platforms, culminates in the roomquarter of 2023, at which time the operation of the integrated market operation would begin ".

On the process, Juan Pablo Córdoba, president of the BVC, highlighted the decision as a great regional achievement of the bolts."The management councils of the three countries have just approved (yesterday) this integration, so we go with all this great achievement.What does it mean for us?It means moving borders and having an even larger vision for the development of the Colombian capital and region market.And now, with all our products and with the collaboration of our colleagues in Peru and Chile, bring that capital market to all companies and all investors, "he said.

Related articleInvestment Bank will assess bags from Colombia, Chile and Peru for possible integration

Una banca de inversión determinó que los valores patrimoniales promedios de las bolsas serían: la Bolsa de Comercio de Santiago (BCS), unos 188.000 million Chilean pesos, the Colombian Stock Exchange (BVC), 895.000 million Colombian pesos;and the Lima Stock Exchange Group (BVL Group), about 503.5 million soles.

In the report they explained that from the consolidation of integration, what is expected is that the rise in annual revenue would be between US $ 21 million and US $ 41 million in the short term (they point out that in the year five), and thefigure amounts to between US $ 27 million and US $ 51 million in the medium term, that is, in the year 8.This, by synergies in traditional business lines and in the development of innovation lines.

Related article"The integration of the four bags offers an excellent opportunity to the alliance"

Just as the BVC decided and communicated yesterday, it was reported that the directories of the BVL group and the BCS did the same, on November 26, 2021 and November 29, 2021, respectively. Y que los acuerdos son similares a los descritos en este documento (ver adjunto al final de la nota).

Another interesting fact that reveals the document is the governance of regional holding.This is how they explained that once created, the instance will be composed, initially, by 16 members, and five of these will be independent directors.

"This initial conformation and its number of directors will be valid for up to two years, the shareholders can make the modifications that it deems pertinent in accordance with the statutes of the Regional Holding," they indicate in the report.

This work began in 2018 when a multidisciplinary team from the Santiago Stock Exchange (BCS), the Colombian Stock Exchange (BVC) and the Lima Stock Exchange Group (BVL Group) began an evaluation process to know what possibilitiesthere were greater integration between the three countries.The objective?"Achieve greater development of the regional market, through a standardization of business models and therefore the generation of technological and operational synergies, among other aspects".

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...