What companies are already in the purchase zone and which do not yet play

- Carlos Simón García

- Cecilia Moya

The year is practically done in the stock market. Los inversores han conseguido altas rentabilidades tanto en Europa como en Wall Street, por encima del 20%. No ha sido tan prolífica la bolsa española, que a falta de cuatro sesiones para despedir el curso, el avance del Ibex ha sido menor al 6%.However, it is time to see the year that enters as a new opportunity to beat the market through the Spanish Stock Exchange, which can be promoted in the recovery of tourism and banking to, finally, strengthening the gap that historically separates it fromits neighbors of the old continent.

This possibility is something that also favors index due to its technical aspect."The rupture of the resistance of the 8.433 points temporarily move the bassist risks and open the door to what could be a final stretch of the upward year in which the Spanish selective will try to close the hole that opened in the fateful day of Friday, November 26, as far as there is a5%rise margin, "explains Joan Cabrero, Ecotrader advisor.More in the medium term, "there will be no sign of weakness in its possibilities of upward reconstruction, which has as its first objectives the return to levels prior to Covid in the 10.100 points, as long as you do not lose the minimum of January 2021 at 7.600/7.700 points, "confirms the expert.

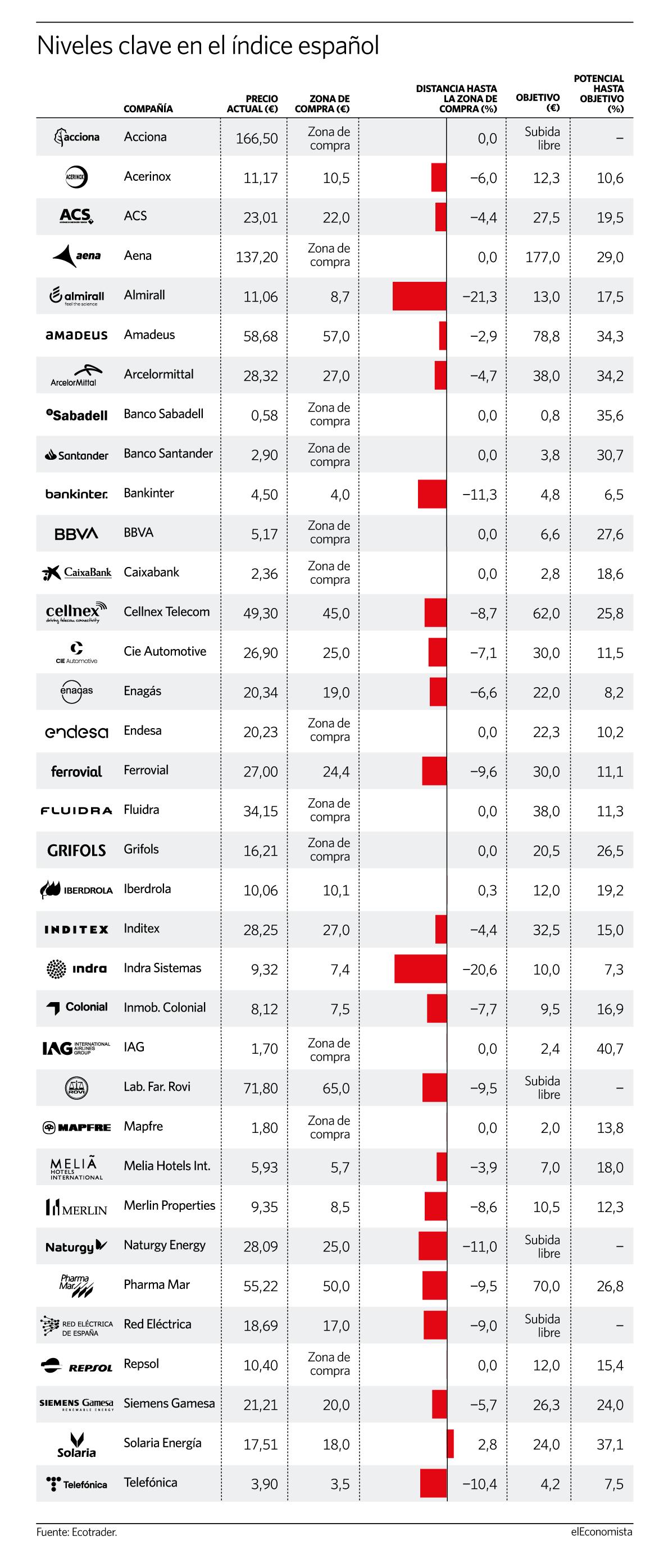

Thus, if you want to make a wallet with Spanish values, within the IBEX there are several companies that after the fall of the start of this week, are already in the purchase zone. De hecho, 12 de las 35 firmas del selectivo nacional serían interesantes ya, según el análisis técnico de Cabrero. Estas son Acciona, Aena, Sabadell, Santander, BBVA, CaixaBank, Endesa, Fluidra, Grifols, IAG, Mapfre y Repsol.

En un momento en el que los bancos centrales, presionados por el incremento de la inflación, ya han puesto sobre la mesa la retirada de estímulos, esto debe ser un catalizador para los valores financieros, especialmente los bancos.In this sense, the technical analysis clearly favors everyone but Bankinter. Santander y Sabadell son los dos títulos que cuentan con un mayor potencial, de más del 30%, hasta sus objetivos."In the case of the latter, I recommend entering a stop loss at 0.533 euros," Matiza Cabrero clarifies.

Another sector, very present in the Spanish Stock Exchange, which must be a key lever in recovery over 2022 is the tourist. Aquí las primeras balas deberían tener como diana IAG y Aena, ambas en zona de compra.The airline is aim.In the airport operator, the potential to the first key novels, which are the top prior to COVID, is almost 30%, setting the level of sale in the 125 euros.

Otra opción apetecible es la de buscar algunos de los valores más castigados de este año, como Endesa y Grifols. La utility, que repartirá dividendo en la primera semana de enero, tiene un recorrido del 10% mientras que la biofarmacéutica catalana, que ha caído más de un 30% en 2021, puede remontar hasta los 20,5 euros, según Cabrero, lo que le deja un camino al alza del 25% desde los niveles actuales."Of course, you have to set a sale price at 15 euros," adds the analyst. Por el contrario Fluidra y Repsol, que son dos de las firmas más alcistas del curso, también están en zona de compra, buscando los 38 en el caso de la primera y los 12 euros en el caso de la segunda. Por último, Mapfre, "donde se puede comprar ya con stop en los últimos mínimos, los 1,7 euros, en busca de superar los 2 euros", concluye.

Types of Hats for Kids: The Perfect Hat for Every Occasion

19/05/2022When it comes to dressing up your kids, hats are a great way to add some personality and style. There are so many different types of hats for kids available on the market today, that it can be hard to...